haytarma.ru Prices

Prices

What Is Cross Collateralization

As a condition to borrow, the lender will usually require that all of the loans be secured by all of the phases of the project. In contrast, a cross-default. For instance, taking out a second mortgage on a property is considered a form of cross-collateralization. Cross collateralization involves using an asset that's. A cross-collateralization clause generally provides that the same collateral, often real property, secures multiple loans from the same lender. In the. A cross-collateral loan uses the same asset as security for multiple loans, offering benefits like increased borrowing capacity and better terms. Cross-collateralization occurs whenever a borrower pledges one asset to serve as collateral to secure multiple loans, enhancing the appeal for lenders. "Cross collateral" refers to a nasty provision contained in most credit union loan agreements. Some people call it a “Dragnet” clause. Cross collateralization is a method used by lenders to use the collateral of one loan, such as a car, to secure another loan you have with the lender. We offer a cross-collateralization financing option to achieve higher LTVs. It allows borrowers to leverage their equity in departing residences, investment. Cross-collateralisation is a form of credit enhancement, used to improve the quality of credit, particularly in structured finance transactions, including the. As a condition to borrow, the lender will usually require that all of the loans be secured by all of the phases of the project. In contrast, a cross-default. For instance, taking out a second mortgage on a property is considered a form of cross-collateralization. Cross collateralization involves using an asset that's. A cross-collateralization clause generally provides that the same collateral, often real property, secures multiple loans from the same lender. In the. A cross-collateral loan uses the same asset as security for multiple loans, offering benefits like increased borrowing capacity and better terms. Cross-collateralization occurs whenever a borrower pledges one asset to serve as collateral to secure multiple loans, enhancing the appeal for lenders. "Cross collateral" refers to a nasty provision contained in most credit union loan agreements. Some people call it a “Dragnet” clause. Cross collateralization is a method used by lenders to use the collateral of one loan, such as a car, to secure another loan you have with the lender. We offer a cross-collateralization financing option to achieve higher LTVs. It allows borrowers to leverage their equity in departing residences, investment. Cross-collateralisation is a form of credit enhancement, used to improve the quality of credit, particularly in structured finance transactions, including the.

Cross collateralization agreements are a form of security that can be used as collateral for many different loans. Cross collateralisation is the process of using the equity in two or more properties as security for a loan on another home. Cross-collateralization occurs in a situation where a credit union uses a motor vehicle as collateral to secure both a vehicle loan, as well as a credit card. Cross collateralization is the act of using one asset as collateral to secure multiple loans or multiple assets to secure one loan. Cross Collateralization is a clause in recording and publishing contracts that allows a record label or publishing company to recoup outstanding advances from. A cross-collateralization clause generally provides that the same collateral, often real property, secures multiple loans from the same lender. In the. The solution to a cross collateralization agreement in bankruptcy is to pay the original car loan through a chapter 13 bankruptcy plan and wipe out the credit. Cross Collateralization is a clause in recording and publishing contracts that allows a record label or publishing company to recoup outstanding advances from. all properties in a cross collateralised structure must be revalued every time you want to purchase another property or increase a loan. This can incur multiple. Cross-collateralization allows businesses to use existing collateral as security for multiple loans. This means a single asset can back several loans. Cross collateralisation is a finance term used when a loan is secured by two or more properties. If you have a home and want to borrow additional money for an. A cross-collateralized loan is where one piece of collateral secures more than one loan. Credit unions often cross-collateralize credit card and signature. The Cross-Collateral Loan is designed to provide financing on the future home, while also collateralizing what will be the former home for the buyer. Cross-collateralization of assets is a financing strategy used by borrowers to leverage multiple properties as collateral to secure a single loan from the. How Your Property can be affected by Cross-collateralization Agreements Cross-collateralization sounds like a frightening legal and financial term. Cross collateralisation – what is it and why is it bad? Back. collateral Cross collateralisation is one of the most common mistakes made by property investors. How Does Cross Collateralization Work? Cross collateralization occurs when a borrower uses the collateral for one loan as collateral for another loan (or. Cross-collateralisation is the process of utilising more than one property as security for a mortgage rather than the traditional one property for one. Cross-Collateralization: In certain limited circumstances, principal and interest collected from any of the loan group I and II mortgage loans may be used to. Cross-collateralizing refers to when someone takes out a loan against their primary residence but secures it with several pieces of real estate instead.

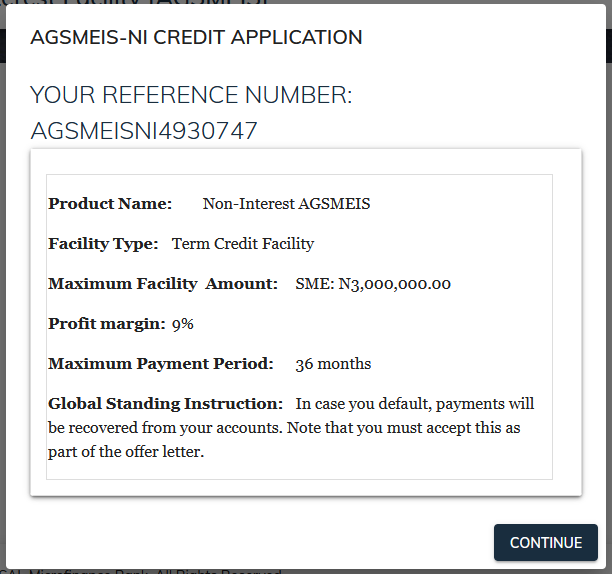

Non Intrest Loan

Waiver of Payments. 15 (1) If a company, under a credit agreement for a loan for a fixed amount, waives a payment without waiving the accrual of interest. The No Interest Loan Scheme (NILS) provides interest-free loans for low-income earners to buy essential household items like fridges, washing machines. The Zero Interest Fund (ZIF) provides zero interest loans in order to promote housing and economic development. ZIF loans, which are awarded up to $, Amortized Loan: A loan to be repaid, by a series of regular installments of principal and interest, that are equal or nearly equal, without any special balloon. Salaries and employee benefits, expenses of premises and fixed assets and other Non interest expense divided by average assets. Provision—Loan/Lease Losses. Non-interest income comes from sources outside of a bank's core activities of taking deposits and managing loans. Banks and credit unions earn a large portion. BANKING. Enjoy quick and easy processing with Zero COT. This account operates under the principle of Qard (Non interest Loan) · WORKING CAPITAL. We hava a. Even though the parent will not receive any interest payments, the parent must nevertheless report the imputed income each year as taxable income on the. Zero Interest Financing You've seen the promotions—buy something now and get 0% financing on your payments, meaning you pay no interest for a set period of. Waiver of Payments. 15 (1) If a company, under a credit agreement for a loan for a fixed amount, waives a payment without waiving the accrual of interest. The No Interest Loan Scheme (NILS) provides interest-free loans for low-income earners to buy essential household items like fridges, washing machines. The Zero Interest Fund (ZIF) provides zero interest loans in order to promote housing and economic development. ZIF loans, which are awarded up to $, Amortized Loan: A loan to be repaid, by a series of regular installments of principal and interest, that are equal or nearly equal, without any special balloon. Salaries and employee benefits, expenses of premises and fixed assets and other Non interest expense divided by average assets. Provision—Loan/Lease Losses. Non-interest income comes from sources outside of a bank's core activities of taking deposits and managing loans. Banks and credit unions earn a large portion. BANKING. Enjoy quick and easy processing with Zero COT. This account operates under the principle of Qard (Non interest Loan) · WORKING CAPITAL. We hava a. Even though the parent will not receive any interest payments, the parent must nevertheless report the imputed income each year as taxable income on the. Zero Interest Financing You've seen the promotions—buy something now and get 0% financing on your payments, meaning you pay no interest for a set period of.

The Zero Interest Supplemental Home Loan Program (ZIP loan) is a loan product available through the University of California's Home Loan Program (“Program”). Interest rates: In , financial institutions saw a dramatic plunge in interest rates, which impacted loan yields and added significant margin pressures. The SBM Zero Interest Medical Loan is a special scheme which has been designed in collaboration with the Ministry of Health & Wellness and select Private. A Personal Unsecured Installment Loan from PNC provides you access to the money you need without requiring collateral. Apply for an unsecured personal loan. To support access to quality early education, JFLA offers zero interest, zero fee loans up to $12,, helping families overcome financial barriers and invest. Non-Interest Banks ; Jaiz Bank PLC, Head office: Kano House, No 73 Ralph Shodeinde Street, Central Business District, Abuja, P.M.B 31, Garki, Abuja. www. interest home repair loans to Detroit homeowners. You pay The 0% Interest Home Repair Loan Program launched in April offers year, interest-free. Possibilities: Your bank: Some banks encourage cash advances but it's zero interest for 6–14 months, depending on the deal. NIB does not provide cash loans to its customers, instead, it offers financing facilities through Non Interest Banking contracts. Can NIB finance customers. Loans and leases ; Debt securities ; Federal funds sold and securities borrowed or purchased under agreements to resell (1). NIB does not provide cash loans to its customers, instead, it offers financing facilities through Non Interest Banking contracts. Can NIB finance customers. Non-Interest Banks ; Jaiz Bank PLC, Head office: Kano House, No 73 Ralph Shodeinde Street, Central Business District, Abuja, P.M.B 31, Garki, Abuja. www. The core purpose of a bank's business model is to loan money, so its primary That said, banks rely heavily on non-interest income when interest rates are low. ZIP is a $, non-amortizing loan with no current interest. A ZIP loan may be forgiven over time with the approval of the Dean. This program can only be. The meaning of NONINTEREST is not of, resulting from, or being interest (as on a loan or an investment). How to use noninterest in a sentence. No Such Thing as an Interest-Free Loan As far as the IRS is concerned, there is no such thing as an interest-free loan. Loans without interest, or at below-. BANKING. Enjoy quick and easy processing with Zero COT. This account operates under the principle of Qard (Non interest Loan) · WORKING CAPITAL. We hava a. The Rural Economic Development Loan and Grant programs provide funding for rural projects through local utility organizations. USDA provides zero-interest loans. Interest-free loans are personal loans that let you borrow money without additional interest charges. This means you'll only be responsible for repaying the. Dallas Hebrew Free Loan Association (DHFLA) provides life-changing interest free loan programs to members of the Greater North Texas Jewish community.